The Best Strategy To Use For Estate Planning Attorney

The Best Strategy To Use For Estate Planning Attorney

Blog Article

Estate Planning Attorney Can Be Fun For Anyone

Table of ContentsThe Single Strategy To Use For Estate Planning AttorneyThe Estate Planning Attorney PDFsThe Estate Planning Attorney PDFsThe Best Strategy To Use For Estate Planning Attorney

Estate planning is an action plan you can utilize to establish what happens to your assets and obligations while you live and after you die. A will, on the other hand, is a lawful document that describes how assets are distributed, who takes treatment of kids and pet dogs, and any kind of various other dreams after you pass away.

Cases that are rejected by the executor can be taken to court where a probate court will have the final say as to whether or not the claim is valid.

The Definitive Guide for Estate Planning Attorney

After the stock of the estate has been taken, the value of assets calculated, and taxes and debt paid off, the administrator will certainly after that seek authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any inheritance tax that are pending will certainly come due within nine months of the date of fatality.

Each specific areas their properties in the trust and names someone apart from their spouse as the recipient. A-B depends on have ended up being less popular as the estate tax go to this website obligation exception functions well for a lot of estates. Grandparents might transfer assets to an entity, such as a 529 strategy, to sustain grandchildrens' education.

The Best Guide To Estate Planning Attorney

This technique entails freezing the value of a property at its value on the day of transfer. As necessary, the amount of prospective resources gain at death is likewise iced up, allowing the estate coordinator to approximate their potential tax obligation upon fatality and far better plan for the settlement of income tax obligations.

If sufficient insurance coverage profits are readily available and the policies are correctly structured, any his response type of revenue tax obligation on the considered personalities of possessions adhering to the death of a person can be paid without considering the sale of properties. Proceeds from life insurance coverage that are obtained by the beneficiaries upon the fatality of the guaranteed are usually revenue tax-free.

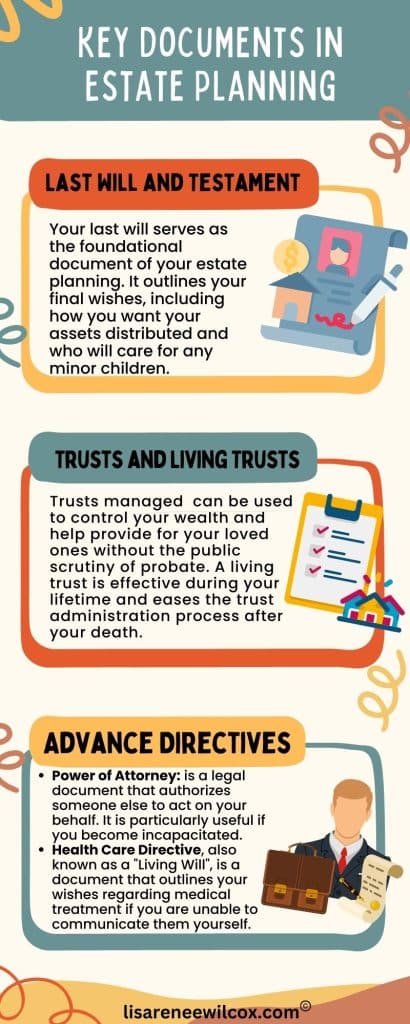

There are particular records you'll more require as component of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is only for high-net-worth people. Estate intending makes it much easier for individuals to establish their desires before and after they die.

How Estate Planning Attorney can Save You Time, Stress, and Money.

You need to start preparing for your estate as quickly as you have any kind of measurable possession base. It's an ongoing process: as life advances, your estate plan must change to match your situations, in accordance with your new objectives. And maintain at it. Refraining from doing your estate planning can create undue monetary worries to loved ones.

Estate planning is frequently believed of as a tool for the rich. Estate preparation is also a fantastic method for you to lay out plans for the care of your minor children and pets and to detail your dreams for your funeral service and favored charities.

Eligible applicants who pass the examination will certainly be officially certified in August. If you're eligible to sit for the examination from a previous application, you might submit the short application.

Report this page